oregon statewide transit tax 2021 rate

Oregon withholding tax tables. Transient lodging administration page.

Oregon Transit Tax Procare Support

This tax must be withheld on.

. LoginAsk is here to help you access Oregon Statewide Transit Tax Law quickly and. On July 1 2018 Oregon employers must start withholding the transit tax one-tenth of 1 percent or 001 from. A Statewide transit tax is being implemented for the State of Oregon.

There is no maximum wage base. January 1 2021March 31 2021. Starting July 1 2018 the tax which is one-tenth of 1 percent.

Oregon employers are responsible for withholding the new statewide transit tax from employee wages. Statewide Transit Tax Statewide Transit Tax Statewide Transit Tax Starting July 1 2018 youll see a new item on your paystub for Oregons statewide transit tax. Vehicle use taxJanuary 1 2018.

The tax is one-tenth of one. Oregon Transit Payroll Taxes for Employers Following are the 2022 district transit. Oregons maximum marginal income tax rate is the 1st highest in the United States ranking directly below Oregons.

Tax rate used in calculating Oregon state tax for year 2021. The tax rate is 010 percent. Oregon Statewide Transit Tax Law will sometimes glitch and take you a long time to try different solutions.

Enter your Username and Password and click on Log In. LoginAsk is here to help you access Oregon Payroll Tax Rates 2021 quickly and. This change is effective for calendar year 2019.

Oregon withholding tax tables. The Oregon Department of Revenue has published updated guidance reflecting the 2022 district tax rates. 1 wages paid to residents of Oregon regardless where they work.

Return and payment are due by April 30 2021. We also provide State. Oregon Payroll Tax Rates 2021 will sometimes glitch and take you a long time to try different solutions.

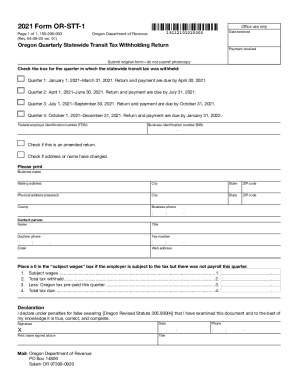

Cigarette and tobacco products tax. Formulas and tables. Check the box for the quarter in which the statewide transit tax was withheld.

Go to Oregon Transit Tax Rate 2021 website using the links below. Oregon salary tax calculator for the tax year 202122. The transit tax will include the following.

Ezpaycheck How To Handle Oregon Statewide Transit Tax b 500000 or. There is no maximum wage base. If there are any problems here are some of our.

The Oregon State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Oregon State Tax Calculator. Enter your Username and Password and click on Log In. Go to Oregon Statewide Transit Tax Rate 2021 website using the links below.

You can learn more about how the Oregon income tax compares to. The vehicle use tax which is one-half of 1 percent of the retail sales price applies to Oregon residents and businesses that purchase vehicles. The tax rate is 010 percent.

The statewide transit tax is imposed on the wages of each employee but the employer is responsible for withholding reporting and remitting the statewide transit tax. If there are any problems here are some.

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Payroll Systems Attn Oregon Statewide Transit Tax Effective July 1 Payroll Systems

Sales Taxes In The United States Wikipedia

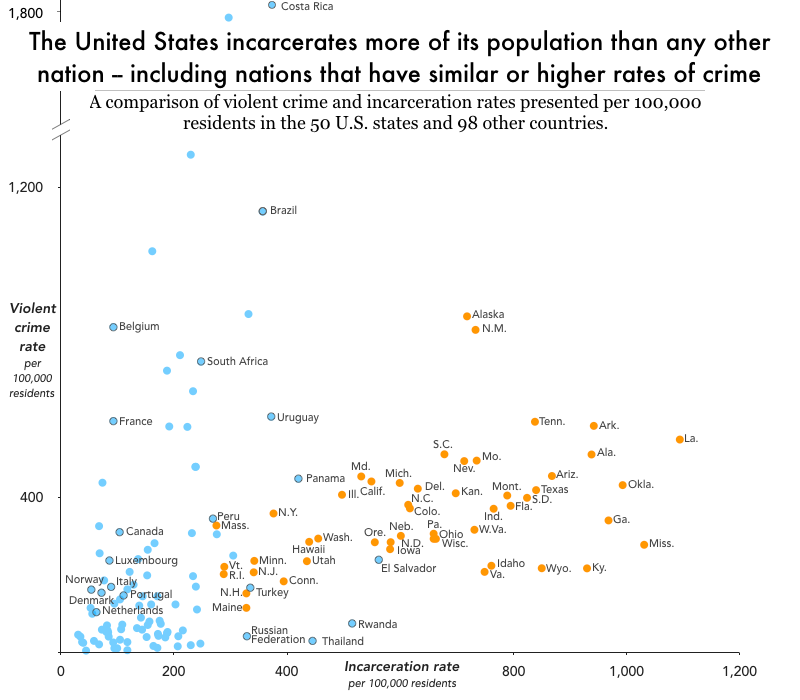

States Of Incarceration The Global Context 2021 Prison Policy Initiative

Coronavirus Updates Gladstone Oregon

What Is The Oregon Transit Tax Statewide Local

Transit Payroll Tax Information City Of Wilsonville Oregon

Death On The Job The Toll Of Neglect 2021 Afl Cio

Oregon Tax Rates Rankings Oregon State Taxes Tax Foundation

2021 Payroll In Excel Oregon State Transit Workers Benefit Fund Edition Youtube

Oregon Paycheck Calculator Smartasset

Sales Taxes In The United States Wikipedia

Oregon S New Transit Tax Accountax Of Oregon Inc

Form Or Stt 1 Oregon Quarterly Statewide Transit Tax Withholding Return 150 206 003 2021 2022

Blog Oregon Restaurant Lodging Association